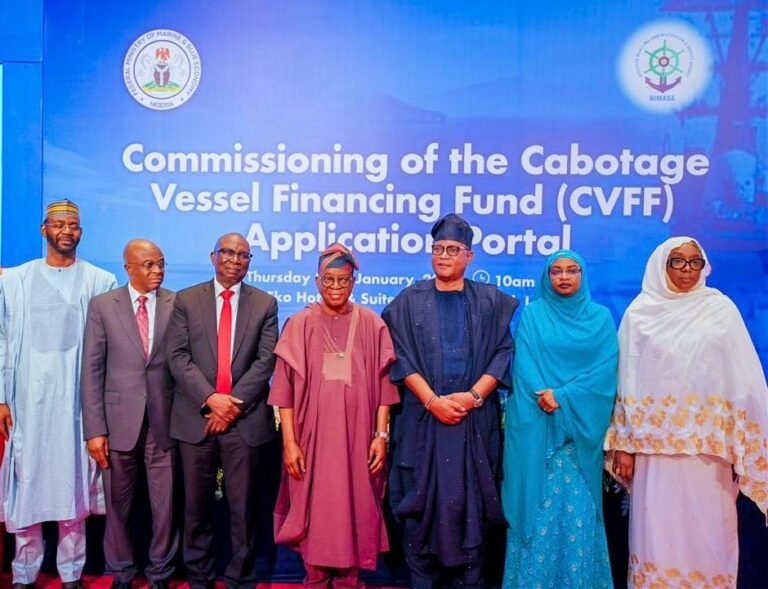

The Minister of Marine and Blue Economy, Adegboyega Oyetola, Thursday launched and unveiled the Cabotage Vessel Financing Fund (CVFF) Application Portal.

The launching he disclosed, marked a historic step in Nigeria’s long-awaited journey to operationalise structured financing for indigenous ship ownership.

Declaring the portal open on in Lagos, Oyetola described the occasion as a deliberate and strategic step in repositioning Nigeria’s maritime sector as a central pillar of national development.

He noted that the launch aligned with the broader national objective of diversifying the economy and unlocking the vast potential of Nigeria’s maritime domain, coastal resources and inland waterways.

The minister in a statement issued by his Special Adviser, Bolaji Akinola, hinted that the maritime sector remains the backbone of global commerce, yet despite Nigeria’s strategic geographic location and vibrant entrepreneurial base, and participation in coastal and inland trade has remained limited.

Oyetola noted: “A major constraint has been the absence of a functional, credible, and transparent financing framework to support indigenous ship ownership. Today, we are changing that narrative.”

He recalled that the Cabotage Vessel Financing Fund, established under the Coastal and Inland Shipping (Cabotage) Act of 2003, was designed to address the financing gap faced by Nigerian shipowners.

However, he acknowledged that institutional and structural considerations over the years delayed its operationalisation.

Oyetola stressed stated that upon assuming office, his Ministry adopted a clear policy objective to strengthen Nigeria’s maritime capacity and ensure that the CVFF is implemented strictly in line with sound governance and financial principles.

“The CVFF is structured as a strategic development instrument,” he said.

“By facilitating access to competitive vessel financing for indigenous operators, we hope to reduce reliance on foreign-flagged vessels in our coastal trade, improve retention of value within the domestic economy, create employment opportunities for Nigerian seafarers, and stimulate growth in allied sectors such as shipbuilding, ship repair, and maritime services.”

He further emphasised that the Fund’s impact extends beyond economics, noting that a stronger indigenous fleet would enhance maritime safety and security while supporting national efforts to maintain a regulated and efficient maritime domain.

The minister explained that the newly launched digital portal would serve as the institutional gateway for transparent administration of the Fund.

“Through this platform, eligible Nigerian shipowners can submit applications that will be assessed against clearly defined criteria, supported by robust due diligence and professional financial oversight through approved Primary Lending Institutions,” he said.

He added that the portal aligns with the Federal Government’s e-Government agenda and efforts to reduce bureaucratic bottlenecks and improve ease of doing business.

“By digitising the end-to-end CVFF application and evaluation process, we are simplifying access, improving predictability, and ensuring service delivery is efficient, transparent, and responsive,” he said.

“I am confident that this initiative will strengthen our shipping industry, empower Nigerian enterprise, and contribute meaningfully to national growth,” he said.

Also speaking at the event, the Director General of the Nigerian Maritime Administration and Safety Agency (NIMASA), Dr Dayo Mobereola, reaffirmed the agency’s commitment to ensuring the CVFF delivers on its purpose.

He stated that NIMASA has established a dedicated Cabotage Secretariat Unit to drive implementation, manage applications, coordinate with financial institutions and ensure strict adherence to eligibility, compliance and risk management procedures.

“Our objective is to make the CVFF work as a practical and reliable financing window for Nigerian shipowners to acquire vessels at competitive long-term financing rates,” he said.

He assured that the agency will ensure professional handling of applications, continuous engagement with Primary Lending Institutions, rigorous due diligence, and transparent monitoring of the entire process.