The Corporate Accountability and Public Participation Africa (CAPPA) has demanded for an upward review of Sugar Sweetened Beverages (SSBs) tax from N10 to N130 per litre.

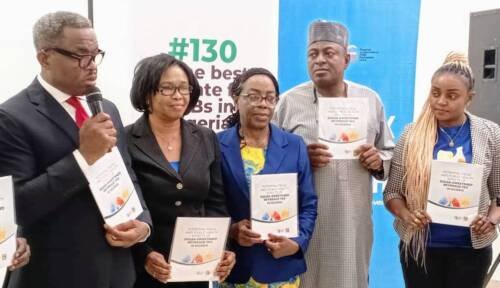

The Executive Director of CAPPA, Akinbode Oluwafemi, made the call on Monday in Abuja at the public presentation of the simulation study of the “Potential Fiscal and Public Health Effects of SSB tax in Nigeria”.

The Executive Director stressed that it was no longer news that the increase in NCD cases in Nigeria was alongside the increase in consumption of SSBs, alcohol, tobacco, trans-fat, unhealthy consumption of salt and other diets that are non-nutritive and injurious to the body.

He said that they understood the current socio-economic struggles of the average Nigerian in an economy that is witnessing too many shocks at the same time.

Oluwafemi noted that the call became imperative considering the issue of public health and the real economic cost of over-consumption of SSBs.

According to him, Tax again? You might want to ask at this current period. Yes! Even economics teaches us that during an economic crisis, nations raise taxes on certain products that are considered not too critical.

Oluwafemi said when Nigeria introduced the N10/litre Excise Duty on SSBs in 2021 through the Finance Act, it was celebrated as a win for public health, but as concerned advocates with history in the long battle against the menace of tobacco and the tobacco industry, it was important for them to take a critical look at the tax and its structure.

He said going by the current inflation rate, the N10 per litre imposed on SSBs in 2021 was possibly worthless than four Kobo because it was a fixed tax, not adjustable to inflation.

Oluwafemi noted that the cries and woes of the Armageddon by paid agents and allies of the SSBs industry must not drown the voice of reason and the genuine concern for people’s welfare.

He pointed out that the damages done to families and loved ones who cater for the sick are enough motivation to see the public rally round the government in doing what is right for the general public.

Oluwafemi stated: “The burden of diseases in Nigeria also continues to impoverish the people as many spend the majority of their earnings on unhealthy diet, which leads to increased health costs, which further impoverishes the people.

“It is a cycle that needs to break. In a country with more than 80% of her population paying for healthcare out-of-pocket, we must find a policy pathway that will effectively remove obstacles to good health and national productivity like modifiable risk factors of consumption related diseases and other NCDs.”

Oluwafemi maintained that the argument of the people who care more about their profit over public health on consumption needs does not outweigh the many benefits inherent in this tax.

Oluwafemi added: “In essence, the SSB tax needs to be increased significantly in the 2024 Fiscal Act, with a framework that is adjustable to inflation as we also begin the conversation about earmarking the tax or a sizeable portion of it for public health.

“The findings of this study have shown that at a minimum of N130/litre, we will see a significant drop in consumption and a decrease in Nigeria’s consumption fueled diseases. I am further convinced that this document provides the government, including the executive and lawmakers, the much-needed data to pursue this policy pathway to a logical conclusion for the benefit of all.”